By Haddon Libby

In April, a data breach of Panamanian law firm Mossack Fonseca provided the largest look yet at the shady underworld of offshore banking. Called the Panama Papers, 11.5 million documents were leaked related to the organization of more than 214,000 offshore shell companies. While some of these entities operate in a legal ways, many do not. A substantial number of these shell companies were used in illegal tax avoidance schemes, corruption, international sanction avoidance and money laundering.

Mossack Fonseca would create complex multilevel shell company structures that could evade laws around the world. More than half of the companies that they structured were based in the British Virgin Islands with the majority of their clients having operations in Hong Kong, Switzerland, the United Kingdom, Luxembourg and Cyprus. Mossack Fonseca also maintained offices in Nevada and Wyoming.

While more than 500 banks did business with Mossack Fonseca, their favorite bank was HSBC. Credit Suisse, UBS, Sweden’s Nordea and two little known Luxembourg banks were also preferred counterparties. The Royal Bank of Canada is in the spotlight as they referred nearly 400 clients to Mossack Fonseca.

Some of the bad actors disclosed in the data breach include UK Prime Minister David Cameron’s father, Russia’s Vladimir Putin, Iceland’s Prime Minister Sigmund Gunnlaugsson (who resigned), Italy’s Silvio Berlusconi, numerous leaders within the Chinese government as well as leadership in the scandal-laden soccer association, FIFA.

It is believed that Sandy Weill, the retired Chairman of Citibank, set-up questionable accounts with Mossack Fonseca as well as 200 other Americans.

President Obama said this of the Mossack Fonseca situation, “Frankly, folks in America are taking advantage of the same stuff.” He went on to say, “Laws are so poorly designed that they allow people…to wiggle out of obligations that ordinary citizens have to abide by.”

In response, President Obama announced that his administration would be taking action to combat money laundering, corruption and tax evasion internationally. The problem with this action is that it does nothing to combat similar problems that occur domestically because of the laws of Delaware, Nevada and Wyoming.

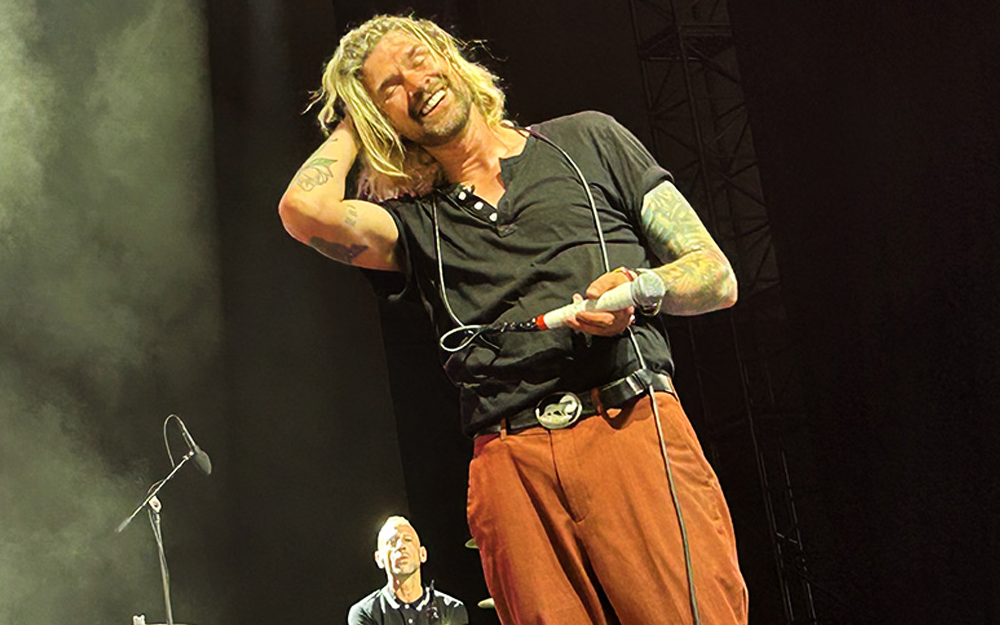

As an example, let’s use noted former billionaire, Tim Blixseth. He has been in jail for over one year because he is unwilling to tell a judge what he did with $286 million in fraudulent transfers from the Yellowstone Club of Montana, an exclusive resort for the ultrarich in Montana. Prosecutors have been unable to track funds from his accounts due to domestic laws that have made it impossible for them to track the movement of monies right here in the United States.

As a refresher, Tim Blixseth used to live in Rancho Mirage at Porcupine Creek, his private residence that included a 19 hole golf course. With a net worth of $1.3 billion in 2006, Blixseth was forced to declare bankruptcy in 2012 for not paying $57 million in taxes. Since then, the court has asked Blixseth for an accounting of that $286 million that he transferred out of the Yellowstone Club. The judge wants to know what happened was to the proceeds of a Credit Suisse loan on the Yellowstone property that ran through a Nevada shell corporation.

The Panama Papers do not show how the United States has some of the best financial secrecy laws in the world. As an example, one can set up a shell corporation in Wyoming, Nevada and Delaware via a financial intermediary called a Nominee Incorporation Service. These services fill out all of the documents needed to form the shell company and then act as the directors for the newly formed business. As the Blixseth case shows, this privacy can be used by bad actors to engage in illegal or fraudulent activities.

Obama would be doing the nation a favor if he used the Panama Papers case to coerce the states of Delaware, Nevada and Wyoming to stop providing these corporate shields that are often used by our country’s bad actors.

Haddon Libby is an Investment Advisor at Winslow Drake and can be reached at 213.596.8399 or HLibby@WinslowDrake.com.