By Haddon Libby

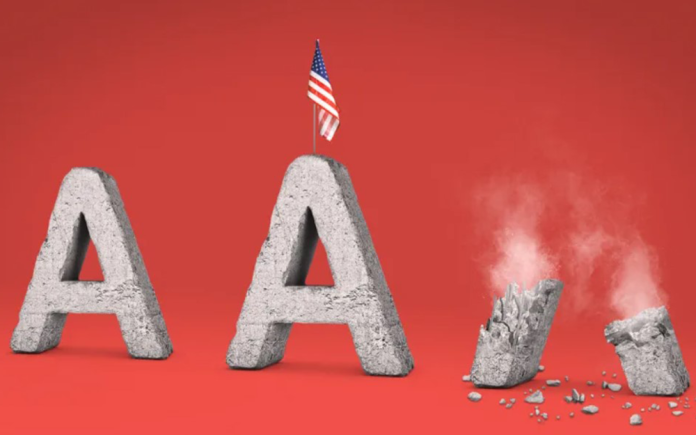

There is a good reason why credit rating agency, Fitch, downgraded U.S. government debt from AAA to AA+ last week. U.S. debt as a percentage of gross domestic product (GDP) has been growing at an increasingly fast rate for the last 20 years. Back in 2000, debt as a percentage of GDP was 33.3%. This level of debt supports an AAA rating. Richard Francis of Fitch states that the mean debt/GDP amongst sovereign nations with an AAA rating is 39%. At the time of the U.S. downgrade, debt/GDP was 112%. While this is better than 2021 when debt/GDP peaked at 126%, projected deficits, unfunded commitments, higher interest rates and increased dysfunction in D.C. were cited as reasons for the downgrade.

Sovereign (government) debt globally is more than $73 trillion. Of this, $31 trillion is owed by the U.S. government. Back in 2000, U.S. government debt was $9.7 trillion.

Overall, total debt by government, business and people in the United States is $93.5 trillion, a $65 trillion increase from $28.6 trillion at the end of 2000. If we adjust the $28.6 trillion for inflation, it would be $77.2 trillion. While $93.5 trillion seems to have grown by an excessive amount, once adjusted for the impact of inflation, the 23-year increase is 21%, or less than 1%/year. If we apply the same approach to a review of U.S. government debt, $9.7 trillion in debt on an inflation adjusted basis becomes $17.2 trillion. This equates to a 3.5% annual increase after adjusted for inflation.

The question is not why Fitch downgraded US debt but why Fitch did not downgrade it sooner. A downgrade has been justifiable for at least ten years.

The downgrade may lead to better long-term rates for you and me. If Treasury bond trading on the day of the announcement are a gauge, the market is selling long-term debt and buying short-term debt. This may be a signal that some of the largest bondholders in the market feel that the rate paid for the longer-term Treasuries is inadequate relative to risk. The downgrade is also likely to cause more money to move toward highly rated corporate debt like Microsoft, Apple, Walmart, or Google.

If market moves on August 2nd are an indication of future events, this may be the beginning of the end of the inverted yield curve. An inverted yield curve happens when short-term rates are higher than long-term rates. At the start of August, the yield curve was inverted by 0.8% as a 2-year Treasury paid 4.8% and a 10-year paid 4%. Inverted yield curves are typically a precursor to a recession…although most economists believe that it may be different this time. The difference is due to the large cash positions held by corporations and those with disposable income as interest rates have risen.

The stock market adage “Sell in May and Go Away” has not worked this year. In July, the stock market moved higher for 13 consecutive days, one short of the record set in 1897. When markets declined on August 2nd (the day of the U.S. debt downgrade), it was the first day since April when equity indices fell by more than 1%. Through the first seven months, the Dow is up 7.5%, S&P 500 20% and NASDAQ 36%!

The S&P 500 and NASDAQ are misleading in that only a few mega-cap tech companies were responsible for performance. Most indices weight each company by market capitalization amount. As an example, the companies of the S&P 500 have a total market value of $38 trillion. Apple, Microsoft Google, Amazon, NVIDIA, Meta/Facebook and Tesla total 35% of value of the S&P 500 and have been responsible for performance. The ten largest companies in NASDAQ in tech and represent half of its value.

While the debt downgrade is likely to have no impact on things, it is a canary in the coal mine. Another old adage is more important to remember than ever – united we stand, divided we fall.

Haddon Libby is the Founder and Chief Investment Officer of RIA firm, Winslow Drake Investment Management. We perform to the Fiduciary Standard of Care in everything we do. www.WinslowDrake.com