By Haddon Libby

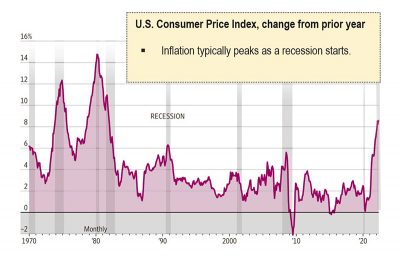

We have been in a ring-fenced recession for much of 2022. A ring-fenced recession happens when those with lower income levels struggle, but upper income earners are relatively unaffected. As inflation has continued, more middle- and upper-income earners are feeling the pinch that lower income earners began feeling a few quarters ago. Given that individuals and businesses came into 2022 in strong financial conditions, the impact of higher prices and interest rates will take longer to slow U.S. demand.

Since WWII, there have been eleven recessions with an average length of eleven months. The longest recession started in 2007 and lasted eighteen months. The shortest was the COVID-induced recession that lasted two months.

In most cases, recessions have been caused by increases in interest rates meant to reduce inflation. War, financial fraud, and higher energy prices have been contributors as well. The 2007 recession was largely due to financial fraud in the housing market.

The current cycle of interest rate hikes has been done to cool a red-hot U.S. economy. This increased demand occurred during a period where supply chains were not functioning well. The Russian incursion and China shutdowns have served to exacerbate issues.

If you have an investment or retirement account with stocks, here are a few investment strategies that may help during volatile economic periods:

Ø Higher rates mean that you should review your mix of stocks and bonds to ensure that you continue to have a proper mix.

Ø Increase direct fixed income holdings like bonds and brokered bank certificate of deposits. Rates are the highest that we have seen in over 15 years. As an example, a bank CD with a 30-day maturity pays 3%, 90 day pays 3.5% and the one-year US Treasury 4%.

Ø Reduce exposure to high growth stocks.

Ø Avoid companies with high debt levels that may struggle to make a profit.

Ø Place an emphasis on large cap stocks with fair valuations and strong management teams.

Ø Add stock positions that pay dividends so that you have the income needed to weather the downturn. For retirees, it is generally advisable to have two years of income available. For working folks, you want to have at least a 90 day reserve in the event you lose your job. Higher income earners are more likely to need a larger buffer as it may be harder to find a similarly paying job.

Ø Stay invested. Over the long-run, stocks remain one of the best assets to hold over time. Pare back risk but stay invested.

Ø Prepare to put cash back to work if stocks fall by another 15% or more, or if Russian hostilities end. View declines as an investment opportunity. Buy low and sell high. Younger workers who are building their 401ks should think of this as the stock market on sale from just a few months ago.

Ø Given the rise in computer and algorithmic trading, stocks will begin recovering while things still look bad. Stocks are a leading indicator meaning that they typically move higher and lower ahead of events.

Ø Given the rise in computer and algorithmic trading, stocks will begin recovering while things still look bad. Stocks are a leading indicator meaning that they typically move higher and lower ahead of events.

Ø History tells us that we can expect a long-term return from equities of 7% to 10% per annum.

If you are concerned about your investments and want a second opinion, send me a request at hlibby@winslowdrake.com and I’d be happy to give it a look.

Haddon Libby is the Chief Investment Officer of Winslow Drake Investment Management. For more information, please visit www.WinslowDrake.com.

This article is for general information purposes and should not be construed as investment, tax, or legal advice, or as a solicitation to buy or sell any specific products.