By Haddon Libby

“A good conscience is a continual Christmas.” – Benjamin Franklin

Americans are expected to fork out $721 billion on holiday-related spending this year, up $33 billion from 2017 reports the National Retail Federation. This equates to a staggering $1,007 per person…or about the price of an iPhone.

“Christmas is a season not only of rejoicing, but of reflection.” Winston Churchill

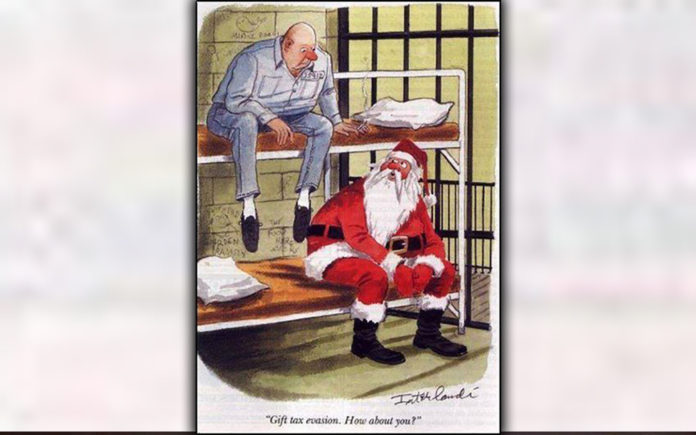

Amidst the hustle and bustle of the holiday season, those who dislike paying taxes need to do a final year-end checkup of their finances to make sure that tax deductions have been maximized. This is of particular importance to Californians as new federal regulations put a limit on the deductibility of state and local taxes. The IRS now limits state and local tax deductions on your Federal taxes to $10,000 for a single person or a married couple. This is a clear marriage penalty to the high tax states that also seem to be Democratically-controlled states. For most people who own a home and earn more than $75,000 a year, this means that you will be paying more in taxes this year.

In order to mute the impact of higher taxes, let’s make sure that tax deductions are being maximized.

The simplest tax break is to put money into a Healthcare Spending Account (HSA). Everyone can add $5,900 per year to their HSA. For those who are over 50 years of age, the limit is $7,900. While you are working, these funds can be used for any healthcare need. What makes these funds the most valuable tax break that you can get is that HSA funds are never taxed. Once you retire, these funds can be used for anything at all in addition to healthcare and remain tax-free.

The next best thing that you can do is to max out your 401(k) contribution if you can afford it. For those under 50 years of age, the maximum contribution this year is $18,500 ($6,000 higher for those over 50). If you are self-employed, think about starting a solo 401(k) plan where you can set aside up to $55,000 ($6,000 more if you are over 50) and let those funds grow tax-free.

If you have stock and bond investments held in a regular taxable investment account like a living trust, make sure that you realize losses of $3,000 this year. Given the volatility in the stock market this year, even the best run investment portfolio had losses in 2018. Now is the time to use those losses in order to reduce your tax bill. Even if you must sell a stock that you really like, you can always buy the same position back after 30 days and not invalidate the write-off.

Lastly, charitable deductions are a way to help those in need while reducing your taxes.

“No man is a failure who has friends.” – It’s A Wonderful Life

As we take time from our busy schedules to wish yule tidings to friends, family and business associates, let us take a moment to consider the words of Bob Hope, “My idea of Christmas, whether old-fashioned or modern, is very simple: loving others. Come to think of it, why do we have to wait for Christmas to do that?” Those words ring true whether said today or seventy years ago. In a politically polarized world where neighbors and relatives end relationships over political positions, try and use the spirit and well wishes of the holiday season to remember what is really important.

On behalf of everyone at CV Weekly, may your holiday season be filled with love, luck and prosperity.

Haddon Libby is a Fiduciary Investment Advisor and Managing Partner of Winslow Drake Investment Management and can be reached at Hlibby@WinslowDrake.com. For more information, please visit www.WinslowDrake.com.