By Haddon Libby

Pope Francis recently said, “These days there is a lot of poverty in the world, and that’s a scandal when we have so many riches. We all have to think about how we can become a little poorer.”

Forbes estimates that there are 1,645 billionaires globally and 492 in the United States alone. The richest of them all is Bill Gates, the founder of Microsoft with a cool $78 billion. To put that number in context, if Gates gave his vast fortune to the 440,000 residents of the Coachella Valley, we would each have $177,000. If Warren Buffet, Larry Ellison and the Koch Brothers did the same, we would each have $631,000.

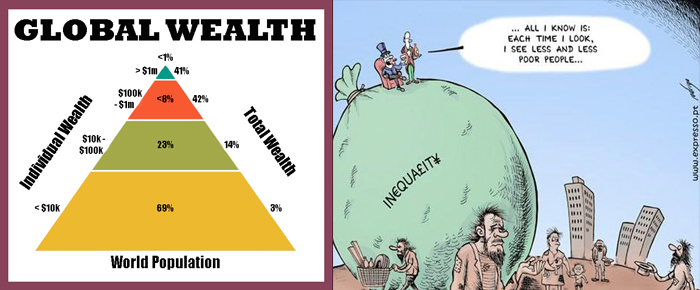

The 1,645 billionaires are worth $6.4 trillion, $1 billion more than last year. According to Credit Suisse, total net worth of the world is 241 trillion. With 7.2 billion people in the world, that means that there is $33,472 of net worth per person worldwide – more than enough to rid the world of hunger and disease.

If you want to be in the top 50% of wealth holders globally, you need a new worth of only $4,000. To be in the top 10%, you will need $75,000. To be amongst the top 1% requires $753,000.

Wealth continues to be concentrated in North America, Europe, Australia and New Zealand. Looking at the United States only, average net worth is $51,600 per person with half of our net worth is in the hands of less than 1% of our population.

Despite this and according to the U.S. Census Bureau, 50 million or 15% of all Americans are food insecure with 5 million being senior citizens and 16 million being children. This means that these 50 million people may miss meals because of a lack of money or access to food assistance. One in six Californians are food insecure with at least one in six food insecure right here in the Coachella Valley.

Part of the problem is that there is too much wealth concentration amongst only a few people who keep the majority of their money in stocks, bonds and real estate. While this money helps to keep the price of those asset types strong, it also means that there is less money available to feed, clothe and shelter the other 99%+.

The Los Angeles Clippers sale is a classic example of what happens with excessive wealth concentration – the overpayment on asset values. Looking at the bigger picture, large companies acquire other large companies at higher and higher valuations. In order to justify the expenditures, those corporations then cut costs which typically means fewer employees.

Studies by both The World Bank and the International Monetary Fund found that the longest and strongest periods of economic growth have occurred in countries where the middle class is the largest and most secure. With each recession over the last thirty years, swathes of middle class jobs have evaporated in the United States due to global competition or technology. While some high wage jobs have been created, the vast majority have been lower paying, lower skill jobs.

MIT economist David Autor says that the shrinking of the middle class will lead to less money for all people over time as the middle class spends more than the wealthy. A large middle class means the need for more infrastructure like roads, schools and airports. They also buy more shirts and food which leads to more employment. With the concentration of resources amongst just a few, there are fewer dollars in circulation which contracts spending further which leads to fewer jobs and another round of economic contraction.

For our economy to strengthen, government and the most affluent have to invest in producing an educated workforce and growing the middle class.