By Haddon Libby

Five years ago, the United States teetered on the edge of a financial calamity that threatened to make the Stock Market Crash of 1929 and ensuing Great Depression look mild. This occurred because of a mortgage market fraught with excesses and fraud as well as wild speculations in the financial markets via an unregulated financial tool known as a derivative contract.

Fast forward to today and few if any responsible for the crisis suffered. Meanwhile, financial markets have a greater level of unregulated risk than five years ago. While banks and regulators have worked hard at removing risk related to bank loans, other risks remain and have grown larger.

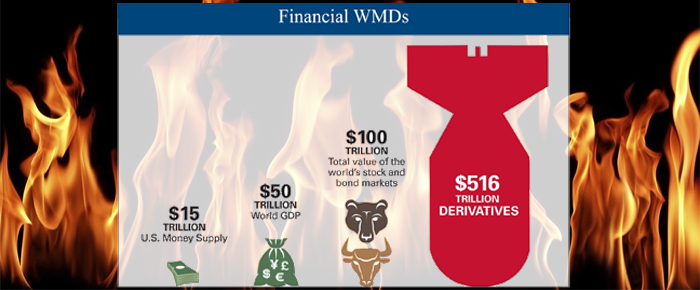

The worldwide derivative markets amounted to $586 TRILLION in contracts five years ago and nearly brought down AIG, Citibank, CIT and many other large financial institutions. Today this market has grown to $633 TRILLION while remaining mostly unregulated. For comparison, the United States has total economic output of approximately $15 trillion, a stock and bond market of $100 trillion and total assets of $200 trillion while U.S. derivative contracts are estimated at 20x all income and 160% of all assets.

As you can see, risk from derivative contracts dwarf those of the mortgage crisis.

A simple explanation of a derivative is that it is a contract between two parties where they trade different types of risk without trading the underlying asset. In its intended form, it is a form of risk swapping or insurance.

The problem that exists in today’s financial markets is that many derivative contracts are simply speculative trades. If a firm engaging in the speculative trades were to fail (like AIG or Citibank), the risk abatement taken by the well intentioned company, bank or governmental body would evaporate thus undermining their own finances. This is where the domino effect of one failure could lead to many more business failures.

For example, if CIT were to have failed five years ago, many small businesses would have lost their financing. This would have in turn caused the failure of many of those one million businesses as well as the failure of other businesses relying on the CIT reliant businesses and so on. If AIG were to have failed, not only would many banks, insurance companies and businesses have failed but many retirees would have lost their retirement income due to the evaporation of their retirement annuities written by AIG.

Another unregulated market that has grown substantially over the last five years is termed shadow banking. The shadow banks are unregulated hedge funds and private equity firms that at present hold $67 TRILLION in assets. For comparison, U.S. Banks hold approximately $13 trillion in total assets.

Freddie Mac and Fannie Mae which failed five years ago, have been recapitalized by you and me via the U.S. Government and now guarantee 90% of all mortgages. This means that mortgage rates and terms are decided by the government and not the free market.

So what could trigger another financial crisis?

As the banks are a smaller component of the financial world today despite the growth in size of four of the top five banks, banks are unlikely to be the cause of the next financial crisis unless an individual bank has excessive exposure to derivative contracts or has loaned too much to the unregulated shadow banks.

Other sizable risks include a rapid rise in interest rates, the withdrawal of government support from the mortgage markets, cutbacks in government spending, a spike in natural resource prices such as oil or municipal bankruptcies and the related impact on investors and retirement funds of which many are dangerously underfunded.

By far, the largest risk is held by the unregulated derivatives market as the failure of even one firm could cause a domino effect throughout both the domestic and worldwide economies.