By John Paul Valdez

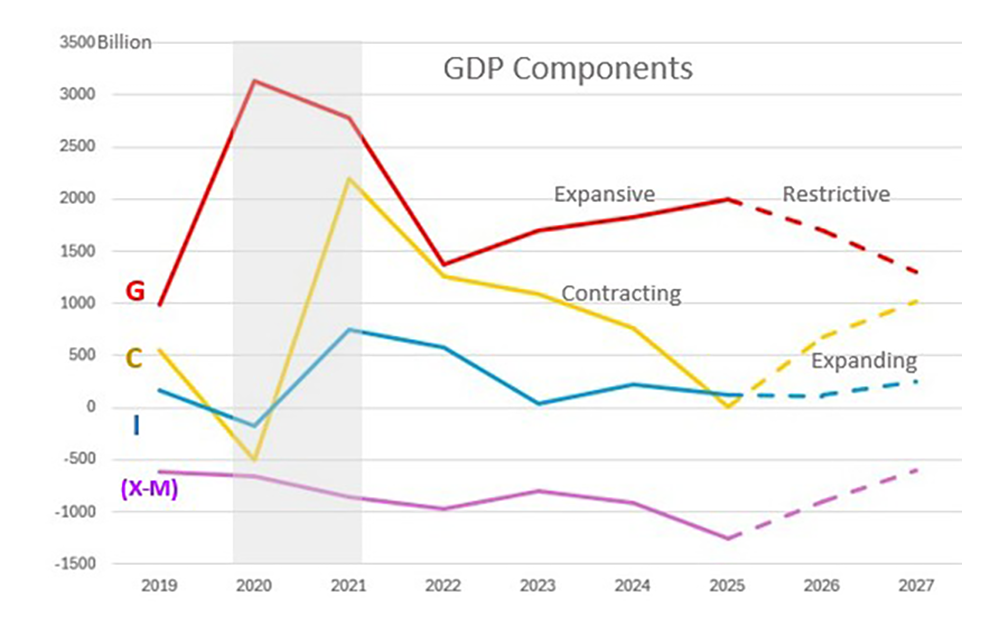

One must be careful what one wishes for. Stability is probably the most valuable thing in financial markets. Unfortunately, the local markets seem to be “enjoying” another bubble. Housing prices have shot up from an unnatural 150 dollars a square foot (too low) to 300 dollars a sq foot in areas where 200 to 250 dollars a sq foot would be a fair market rate. Along with the volatility comes a whole wave of investors that ride waves and cause the very boom and bust cycles they later abhor when they are on the losing trade of that movement.

This is a tourist area. An equivalent would be to say it’s a Sitges next to a Barcelona, or a market where those who can afford such things frequently buy second homes or perhaps a rental property. Persons who can afford to wait out markets for years at a time are less subject to buying and selling in markets without expertise where they can otherwise have a tendency to get too greedy and end up burned as in the last cycle. On the one hand lending practices have tightened up, but on a principal residence some would argue that lending needs to loosen up. One must look at markets within markets and understand their place in them to invest properly.

Many new improvements and developments are coming to the PS area. One sad note is the statue of Marilyn Monroe that is leaving. As she was discovered right here at The Racquet Club, PS has some rightful claim to her legacy, and I for one would be happy to see a commissioned sculpture replace the one on its way to New Jersey. The sculpture represented an economic boom to the city.

Lastly, our neighbor to the north, DHS, is still in a financial crisis. The solution? Not one, but TWO new giant taxes being proposed in an area that is severely lacking in infrastructure and responsible planning. First, local government is putting a parcel tax that represents a 500 percent increase in owning land here on the ballot. Not that all taxes are bad, but when you pass a big new tax initiative you should be buying something or improving something or investing in something, not just meeting your overdrawn bank accounts from mismanagement and poor decision making or even alleged corruption. The second tax would come from the city abandoning its parks and handing the whole problem over to the county where the city would then be assessed (well, each property owner would be assessed) for parks and recreation. This is the “new” administration that ran on a “NO NEW TAX” pledge. Curios that.

A five acre park that had been agreed to by the Skyborne developer was never put in, and now the city wants to assess its population for its failures in enforcing its agreements with developers. Without proper management, and without proper investment in infrastructure to a city, higher real estate prices will never have real support and this will in turn only lead to even more volatility in the marketplace for those who can least afford it.

You can’t just tax your way into heaven and out of your problems. Strategic city planning is the real need to the sister city to PS that is DHS. Property taxes and assessments, it should be said, hit our fixed income population the hardest.

Questions and comments: JohnPaulValdez@gmail.com