By Haddon Libby

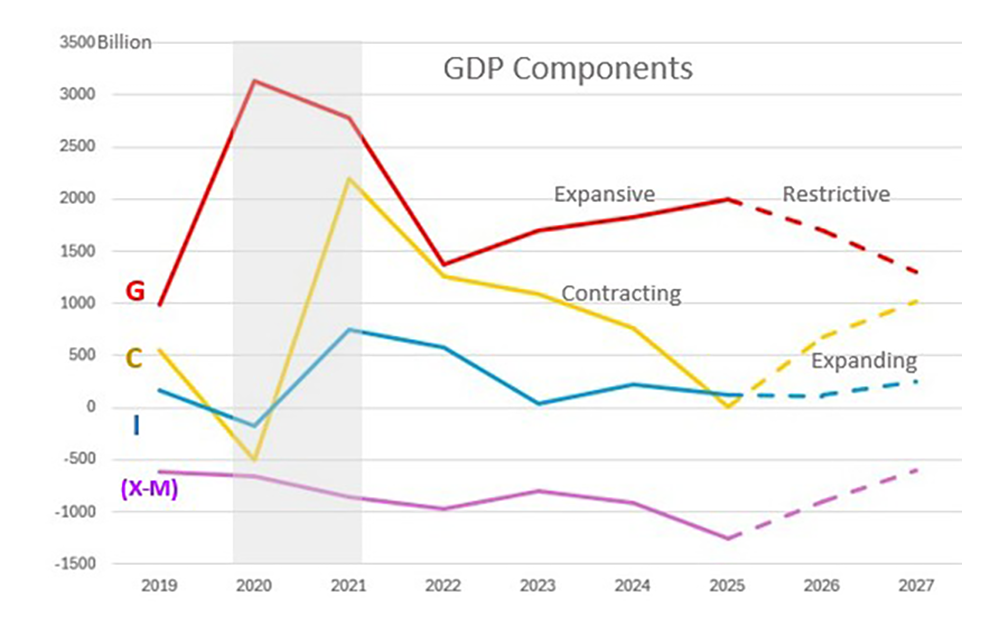

This has been a banner year for investors. At the start of the year, most feared a recession caused by higher borrowing rates and inflation. At the mid-month point, the US stock market was up by 25% to 30%.

Given the great year that most investors have had, it might be time to look at the mix of assets in your 401k or investment account to see if any changes might be necessary.

The first thing to figure out is your risk level. Younger investors typically keep most if not all assets in stocks or alternatives. As the stock market can be volatile, the more youthful amongst us have a longer time to recover from market declines. As people age, they tend to take less risk and therefore keep more in bonds and bank CDs.

Cash is considered the lowest risk option. Given that inflation erodes its value by 3%/year, this is probably a bit too conservative for most. Cash in an investment account can easily earn more than 4%.

Next would be a bond portfolio. Over time, this asset type can be expected to pay 4%. At present, bonds are yielding a bit more than the historic average.

If you hold bonds via a fund, be aware that higher interest rates can cause this ‘safe’ asset to fall in value by more than the interest rate received. When interest rates are stable or declining, bond funds work. My preference is to own the underlying bonds to maturity as I know what I’m earning. I also prefer investment grade bonds versus high yield bonds. If I want a higher yield, I’m more likely to put those funds in the stock market versus a risky piece of paper that often does not pay enough to make up for the risk incurred.

Before discussing stocks, let’s take a quick look at alternatives. Alternatives include investments like gold, silver, partnerships, hedge funds, options, and bitcoin. These are typically more speculative investments. Where gold has been the historic store of value against inflation, many see bitcoin as a future alternative.

Stocks make up the largest percentage of most investment portfolios. Professionals advise that you hold a diverse mix of stocks. Diversification comes by holding companies of many sizes that operate in many industries around the world. Roughly 60% of all stocks are in the United States.

Most stocks are blocked into one of eleven sectors. Technology stocks represent the largest stock with 30% of all stock market value. Other sectors include Financials (13%), Healthcare (12%), Cyclicals (10%), Industrials (9%), Communications (8%), Consumer Staples (5%), Energy (4%), Utilities (3%), Real Estate (3%) and Materials (2%).

When building a portfolio, diversification typically provides better performance over time. The US stock market has 70% in LargeCap stocks with 20% in MidCap and 10% in SmallCap. At the same time, about 25% of stocks are considered Growth stocks with 30% considered Value stocks with the remaining 45% in Core stocks.

So how do you use all this information to see if your mix of assets is what you want?

Once you have determined the split between stocks and bonds, you want to make sure that the stocks or funds that you use stay within the general percentages of the market. All too often, investment portfolios are built for one moment in time and do not adjust to changing market conditions. As an example, many people had more in energy stocks when the price of oil was rising yet kept those percentages in place as valuations fell.

Looking at the next year, will the threat of tariff wars lead to a weaker performance for non-US stocks? If you believe this, you might want to keep those holdings smaller than market averages.

If all this is something you avoid, talk to an investment professional who can help.

Haddon Libby is the Founder and Chief Investment Officer of RIA firm, Winslow Drake Investment Management. For a free portfolio review, please visit www.WinslowDrake.com.