By Haddon Libby

Wild swings in the stock markets this year have been largely due to ‘algo’ trading.

Never heard of this method of trading? Algo is short for algorithm. Algo trading means that the buying or selling of a stock on bond is based on an algorithmic program. Most algorithmic programs measure market data real-time and make buy or sell decisions prior to analyzing the meaning of that data.

Last week, CNBC reported that 80% of all trading was done by algos while the other 20% was split between professional managers and the public. Algo trading caused wild swings to the downside as there were not enough humans or algo buyers out there to offset all of the algo sellers rushing for the exits. Exacerbating the situation, human investment managers are increasingly spotting these computer-induced sell-offs and remaining on the sidelines until the crush of computer-induced selling has ended.

Making things worse, most of these same algorithms consider the market gyrations that they create as further signals of future market outcomes. Simply put, algo trading creates the stock market equivalent to ‘fake news’ causing markets to act in seemingly illogical manners on an increasing basis.

So what freaked out the algos last week and had them all running for the exits?

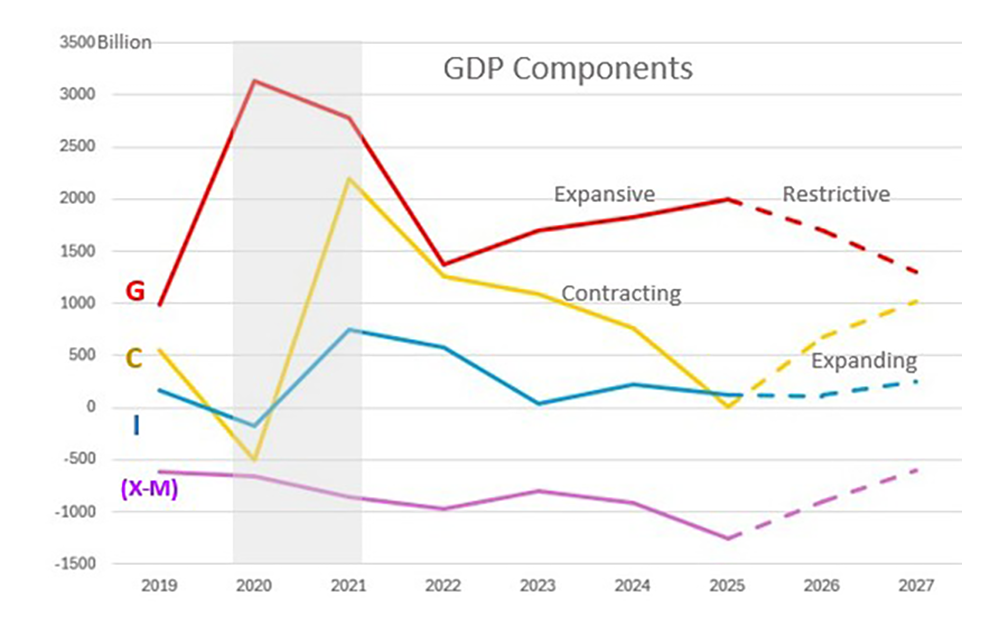

The three-year Treasury bond briefly paid investors a higher interest rate than the five-year Treasury bond. The algos hated this as history tells us that there is a 100% chance of a recession when short term interest rates are higher than long term interest rates (also called the inversion of the yield curve). While short term rates are currently lower than longer term interest rates, the rate differential is at some of the lowest levels in a long time. What makes it a little different this time versus every other time in the past is that long-term interest rates are being heavily manipulated by the Central Banks of Europe, the United States and Asia.

Central banks manipulated long term rates by owning a lot of their own debt. The European Union took this one step further and bought corporate debt as well. By reducing the supply of longer-dated fixed income investments aka bonds, long-term rates have stayed much lower than they would be if not for such interventionist policies.

As part of efforts to revive the U.S. economy after the Great Recession, the U.S. Treasury bought $3 trillion of debt in the financial markets. This was on top of the $6 trillion owned by government agencies like the Social Security Administration. When you consider that the European Union, Japan, China and other large governments engage in similar behavior on an increasing basis, you can also understand why current interest rates do not reflect whether we are going into a boom or bust period. If these governments issued debt held on their books into the public marketplace, rates would be much higher. Economic output around the world would be much lower too as higher interest rates would crowd out other investment options. Higher long-term rates would make it harder for people to buy homes which would cause home values to decline and tax revenues to fall. With lower government and consumer spending, a recession would be imminent.

For now, remember that we are just exiting one of the best years for the U.S. economy in nearly fifty years. It is very hard for an economy to go from expansion to contraction so quickly. As evidence, look no further than the Great Recession as it took the better part of ten years for many parts of the U.S. economy to stabilize and recover.

As our current scenario has never happened before, it is likely that algo traders are making decisions on flawed models.

Haddon Libby is Managing Partner for Winslow Drake Investment Management and can be reached at Hlibby@WinslowDrake.com. For more information on their services, please visit www.WinslowDrake.com.