By Haddon Libby

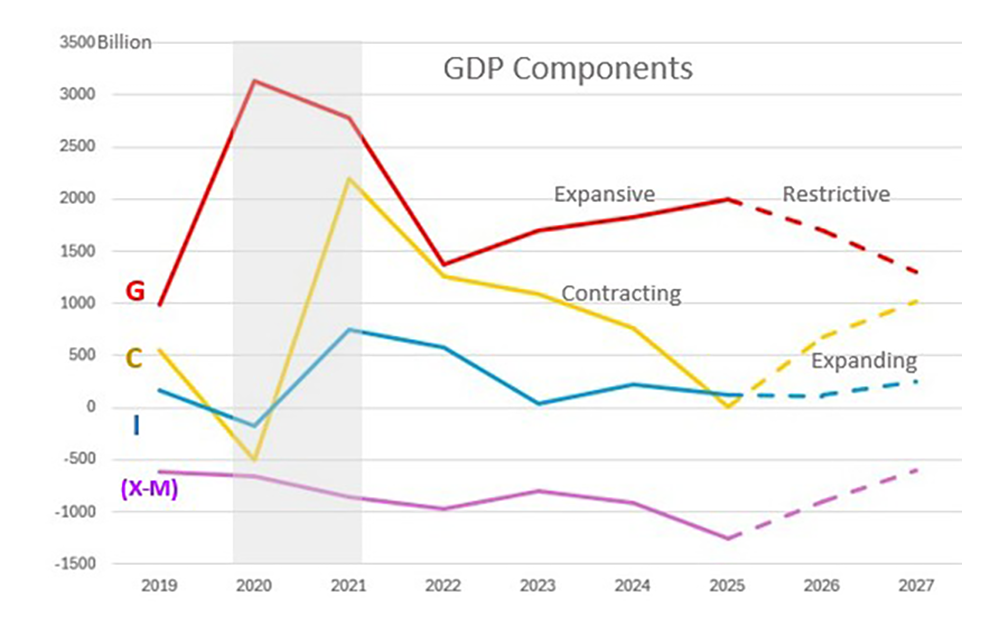

Over the first seven months of this year, the Dow has declined 7.4% while all non-US stocks were off a comparable 7.3%. Looking inside the numbers, the pandemic has expedited our conversion to a digital economy. This is best exhibited by the performance of the Technology sector that is up 22.5% this year versus the Energy sector which is down 38.2%.

As one might expect during a global health crisis, healthcare is up 9.8% while financials are down 15.3%. Financials suffer from the dual threat of anticipated defaults in consumer and corporate debt as well as the lowest interest rates in history.

Consumer Goods stocks were up over the last seven months as people were spending more time at home. Consumer income was up during the second quarter despite the largest decline in GDP on record. These disparate signals are due to $600/week bonus in unemployment benefits that served to increase income for the bottom half of wage earners who were furloughed or laid off. Stimulus checks sent to families earning less than $150,000/year served to support spending while growing deposit accounts.

Relief and stimulus payments have led to the rapid growth in first time investors. Their participation in the market partially explains the gravity-defying valuations of stocks like Apple or Tesla. While these companies will certainly benefit from the new normal, stock valuations appear to reflect more optimism and brand-washing than is supported by business projections.

In addition to trillions in government payments to most Americans by the US Treasury, the Federal Reserve overwhelmed the fixed income markets by buying more than $5 trillion in government and corporate bonds. By keeping interest rates low, the Federal Reserve used brute financial strength to force rates lower and help individuals, businesses and governments afford higher debt levels. Without Federal Reserve intervention in the markets, credit would cost more at a time when most borrowers can afford it least.

This extraordinary assistance should lead to several side effects.

The most side effect is higher prices aka inflation. Inflation will be modest to start as workers and businesses compete for income keeping prices low. Over time, the reduction in prices will be more than offset by rising costs.

By holding rates artificially low, those relying on fixed income have lower incomes. While few will cry for the insurance companies and banks that earn less as a result, artificially low interest rates hurt our oldest Americans who rely on bond and bank CD interest as safe income sources in retirement.

Low rates cause many investors to take on more risk in order to achieve desired income levels. People who might have kept their money only in bonds will venture into stocks, real estate and other more speculative investment options.

Aberrations caused by historically low interest rates create nearly ideal business conditions for some companies. Companies that sell goods with the ability to increase prices in line with inflation could see their valuations go up at the rate of price increases.

As the Federal Reserve have stated that they expect to keep interest rates abnormally low for as long as it takes, the price of things is certain to go up. This means that assets like real estate and equities will go up in value due to the decline in the value of the underlying currency aka inflation.

What does all of this mean to you?

Assets like your home or investment account can be good stores of value. Like any asset, the price that you pay for the asset matters.

What if you don’t have many assets?

The sooner you can fix your living costs and begin saving, the faster you will begin accumulating wealth.

If you or a friend is out of work or job unstable, one of the best things that you can due to improve job prospects is to encourage everyone that you know to wear a mask when around others and practice social distancing. Until infection rates go down and consumers feel safe to go out, economic activity will be too low to support the employment of people on furloughed or laid off.

The longer we have lower business activity, the greater the destruction of jobs.

Haddon Libby is the Founder and Managing Partner of Winslow Drake Investment Management. For more information, please visit www.WinslowDrake.com.