By Haddon Libby

July was the best month of the year for stocks as the Dow was up 6.7%, the S&P 500 +9.1% and tech-heavy NASDAQ 100 +12.3%. Dow and S&P 500 results were the best that we have seen since November 2020 while the NASDAQ had its best month since April 2020. For comparison, the Dow was down 6.7% in June, the S&P 500 8.4% and the NASDAQ 8.7%. July’s strong performance was welcomed relief from a year that has posted the worst results since 1970. Following July’s rebound, the Dow is off 9.6% for 2022 with the S&P 500 down 13.3% and the NASDAQ 20.8%.

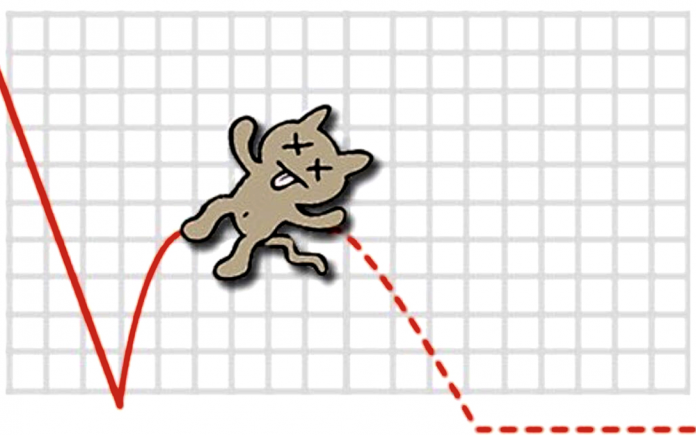

Was the July rally something we can build on or might it have been the proverbial ‘dead cat bounce’? The morbid saying refers to the price action of a stock or market. A dead cat bounce occurs after the market has moved down swiftly. The bounce is usually half of the original loss. At some point, gravity comes back into play and the cat falls back to (and sometimes past) the original low.

The market’s move higher coincided with the Fed’s second 0.75% rate increase in three months. At present, the Fed Funds rate is 2.25%-2.50%. According to Chairman Jay Powell, we are 0.50% to 0.75% from the 3% Fed Funds rate that the Federal Reserve Board targets. The implied Fed Funds rate levels as forecasted by the market suggests that we can expect a peak Fed Funds rate in the 3.25%-3.50% area.

While the Fed increased rates, interest rates paid in the bond markets fell. The Fed Funds rate went up 0.75% but the yield paid on bonds went down. This seemingly counter-intuitive decline is due to a belief that the economy is slipping into a recession.

Jeffrey Gundlach, founder of DoubleLine and David Kelley, Chief Global Strategist at JP Morgan have stated that they hope that the Fed takes a breather on rate increases at one of the next two meetings. Both are concerned that the Fed could overdo it when increasing rates. Both feel that the economy can handle another 0.50% in rate increases. Anything more could have a more profound impact on demand. Remaining Fed meetings this year are on September 20-21, November 1-2 and December 13-14.

What does all of this mean for my 401k or investment account?

As it relates to bond returns, we may be nearing peak interest rates over the next 3-6 months.

As it relates to equities, we will need a catalyst if we want recent rallies to stick. China returning to a normal operating environment would help smooth supply chains. The disruption to global food and fuel supplies caused by the Russian invasion of Ukraine is another challenge hurting global markets. While market concerns over food and fuel have receded with summer crops, it still appears that many countries will struggle this winter as natural gas and grain supplies look insufficient for expected demand.

As stock markets typically price to expectations in twelve to eighteen months, we should expect the end of this downward bias toward equities over the next few quarters so long as supply chains begin to normalize. Do not be surprised if the market retests June lows as markets are prone to overreacting to both the upside and downside. At present, companies are revising earnings estimates to reflect slowing sales and higher operating costs caused by inflation. A strengthening U.S. dollar (up 10% this year) is also causing multinational companies to post lowered results as activity in other countries is converted to U.S. dollars. As an example, currency translation reduced Microsoft’s 2Q results by 3%. Currency translation is another factor that will slow U.S. exports.

Once these extraordinary events begin to fade into the past, we should return to a normalized business environment.

For now, investors need to be prepared for more volatility and lower valuations. Use the current market recovery as a chance to rebalance your portfolio. Now is a great time to sit down with your investment advisor and assess whether your current mix of investments is the right mix of assets for you at present and for the future.

Haddon Libby is the Chief Investment Officer and Founder of Winslow Drake Investment Management. For more information on our services, please visit www.WinslowDrake.com. This article is not a recommendation to buy or sell any security.