By Haddon Libby

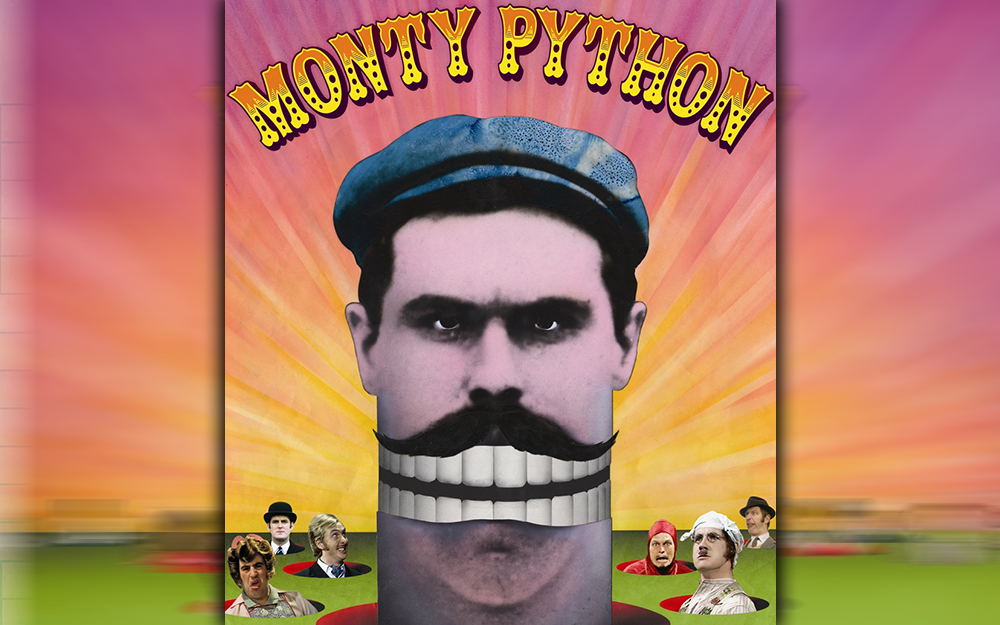

In 1980, the comedy troupe Monty Python sang, “The world today seems absolutely crackers. With nuclear bombs to blow us all sky high. There are fools and idiots sitting on the trigger. It’s depressing, and it’s senseless.”

We need look no further that the dysfunction in Washington DC to see Monty Python’s words in action. Both political parties get behind candidates who have proven their inability to serve in the most important job in the world. The parties offer the equivalent of 77-year-old Coke and 81- year-old Pepsi when we want uncontaminated water.

While dysfunction rules in DC, the federal deficit grows at an unsustainable rate.

At present, US government debt equates to more than 120% of the Gross Domestic Product at $34 trillion. For comparison, US debt was 60% of GDP twenty years ago and just 30% when Monty Python recorded the song referenced above (song is “I Like Chinese” from “Contractual Obligation”).

At year-end GDP was $27.6 trillion, up $15 trillion in twenty years and $24 trillion since 1980.

Another way to look at a nation’s debt is to combine all debt owed by a governmental entity, business or individual in a specific country. Using that barometer, global debt is roughly 240% of global GDP.

All US debt to GDP has grown from 163% in 1980 to 275% today.

Is this a lot of debt or a manageable level?

Think of your own finances. Let’s say that you earn $100,000 annually and own a home with a mortgage. You would have $275,000 of debt outstanding. At a 5% interest rate that is paid back over 30 years, your payment would be about $1,500/month or $18,000 annually – a payment that seems quite manageable.

The debt level is not the problem. The issue is with the way income is spent. Whether it is a person, business or country, if you are spending beyond your income level, it should be on things that will increase your income level.

For example, if you use debt to buy an asset like a home, taking on the debt is an investment that increases your net worth while lowering your living costs (if not immediately, over time). If the debt is used to lease a car that you could not afford otherwise, a nice dinner out or groceries, you are creating a problem that will need to be dealt with down the road.

For as bad as the US government has been at managing its financial affairs over the last 25 years, China’s financial situation is worse. At the end of 2023, debt to GDP was nearly 300% with outstanding obligations of $50 trillion (71% in 1980). Much of this was used to build cities that sit empty or incomplete. China invested in production capacities that are falling vacant as US companies move operations to countries unencumbered by the geopolitical problems presented by doing business in China. Add to that government waste and subsidies to the goods and services its people need, and you have a situation that appears far more challenging to resolve than that faced domestically.

Japan’s debt level has grown from 230% in 1980 to 450% at present. Where this level of debt would lead to a depression in most countries, Japan is a bit different as the country monetizes some of its deficits by issuing a 0% debt that the Bank of Japan (its Federal Reserve) holds. The way the financial markets are set-up, its people finance these debts as part of their retirement savings.

At the end of the day, if debt leads to a higher net worth or income level, the debt was productive. If not, harder financial times most likely await. For now, the US is growing its income quickly enough to support dysfunctional DC.

Haddon Libby is the Founder and Chief Investment Officer of Winslow Drake Investment. Please visit www.WinslowDrake.com for more information on our services.