By Haddon Libby

The Dow Jones Industrial average is above 35,000 and the S&P 500 is over 4,500. Both mark all-time highs for each index. At the same time, the 10 year Treasury pays a skinny 1.25% while a 30 year Treasury note pays only 2% – both near all-time lows reached last year during the pandemic. Global food costs are up, on average, 30% from last year while the Delta variant continues to wreak havoc on our hospitals and way of life.

A casual look at these barometers of economic health seems in contrast. How can equity markets be reaching all-time highs when interest rates are low and inflation high?

Do these all-time high prices for equities meant that the market is over-valued? Given people are paying to buy these equities, the general presumption would be that stocks are fairly valued as you have buyers and sellers agree to exchange shares at these prices.

Could the fast appreciation in stock prices mean that stocks might be undervalued?

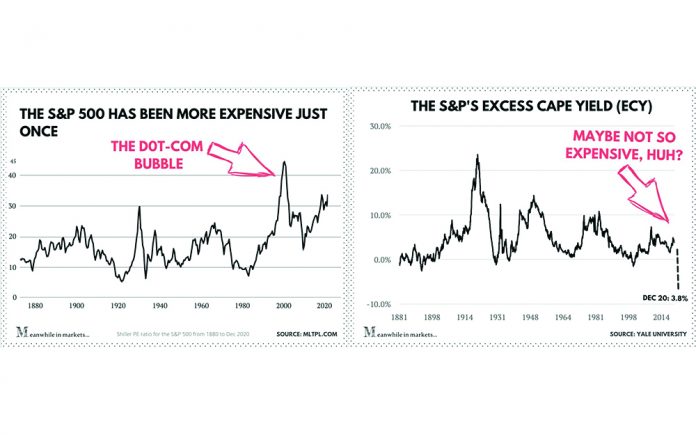

Yale professor and Nobel Laureate Robert Shiller has spent his life measuring and analyzing such things. Shiller created the Cyclically Adjusted Price-to-Earnings ratio (CAPE Ratio) when determining whether equity markets are fairly valued. His approach uses corporate earnings over the last decade (vs. one year) when looking at valuations. Using that index, Shiller found that stock prices are the highest that they have been since the peak of the dot.com bubble in 2000.

Is that a sell signal?

The problem with the CAPE Ratio is that is fails to consider our historically low interest rate environment. Lower interest rates mean that stocks can support higher price-earnings multiples as fewer dollars go into the servicing of debt. This causes earnings to rise. Conversely, if interest rates jumped significantly, higher interest costs would consume more earnings, price-earnings multiples would fall, and stock valuations would decline.

Schiller’s CAPE Ratio provides an accurate gauge so long as interest rates are in line with historic levels. Professor Schiller realized this flaw to the index and shifted his work toward an Excess CAPE Yield when valuing stock markets. The Excess CAPE yield is calculated by inverting the CAPE Ratio and the 10-year inflation-adjusted interest rate. When we look at this indicator, stock valuations are right around those of ten years ago. Stated differently, the excess CAPE yield suggests that the market is near its lowest valuation of the last 10-15 years due to negative real interest rates.

Watching bond yields is another way to get an early indicator on equity market valuations. With the price differences between corporate debt, junk debt and US Treasuries historically narrow, market participants imply that they are not worried about a surprise spike in interest rates or a significant change in negative real rates.

As hard as it may be to believe, Professor Schiller and the bond markets are indicating that we may be closer to the start of this bull rally than its end. This is not to say that there are not widely overvalued stocks and speculation afoot – there are many. What it does say is that well-run companies that are not at the epicenter of the global pandemic look to have a Goldie Locks operating environment over the next few years. Unless we see a sharp rise in rates, the economic environment looks solid with an accommodative Federal Reserve.

If all of that is not enough to indicate that stock prices will remain at elevated levels, the TINA effect (There is no Alternative) will certainly help stocks over time. With interest rates so low, more investors are expected to pile into equities as one of the few investments that can help investors grow their portfolios by the inflation rate.

Then again, the stock markets are a fickle thing today’s rosy outlook could disappear quickly with a surge in any one of the storm clouds off on the horizon.

Haddon Libby is the Founder and Chief Investment Officer of Winslow Drake Investment Management. This article is in no way meant to be financial advice. Please see your financial advisor or contact us at www.WinslowDrake.com for financial advice.